As housing advocates designing housing for a disability-forward future, it is important to know where the money can come from to build housing, both generally and specifically affordable housing. It is also important to know about the key players and words that define how housing gets built and how housing can become more affordable. To start, we think it is important to know about the general steps to build housing.

What are the Phases to Build Housing?

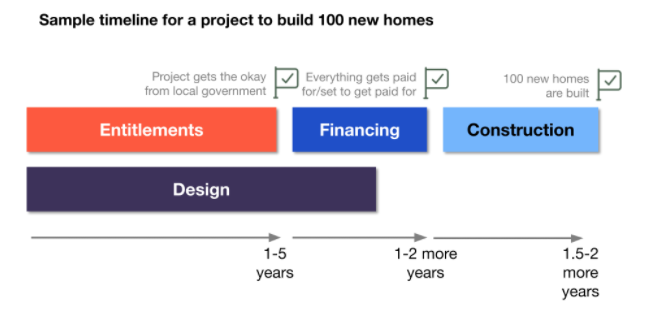

- Entitlements: Getting the okay from local governments to build a housing project. Defines things like the number of units, how tall/big a building can be, and certain project features like outdoor space, parking, and other requirements.

- Financing: The money needed to pay for a project. For affordable housing, this comes from many different places.

- Design: The owner of the housing working with an architect. They design the building based on who will use the building.

- Construction: The owner of the housing working with a contractor or construction company. This is when the building is actually built.

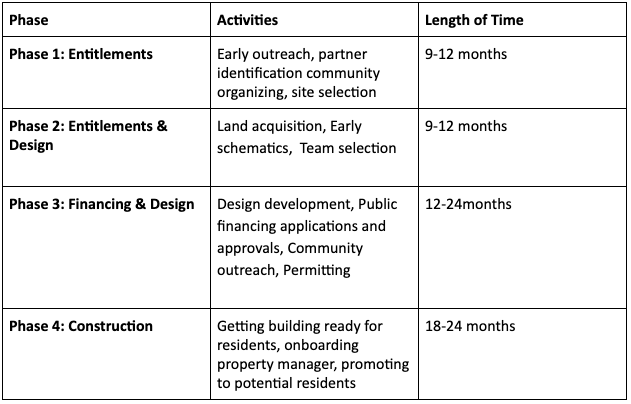

How long does each phase take?

Affordable housing does not spring up overnight. It is a multi-step process that requires patience and planning. Within the financing stage of building housing there are phases unique to funding. The table below displays these funding phases that you can anticipate for your project, the activities expected during each phase and the length of time each should take.

Why is Affordable Housing so Challenging and Expensive to Build?

One reason creating affordable housing is so difficult is because lenders typically loan money for a housing development based on the property’s expected income. With most market-rate projects, the expected income from rents outweighs the amount borrowed, lent or contributed. When rents are set at affordable levels, there’s a huge gap between the money needed to build and the money lenders and investors provide. This requires creative and resourceful people developing affordable housing when seeking to close that funding gap.

How is Affordable Housing Funded?

This is a critical question that demands a transparent answer in order to prepare yourself for the process. Here are some funding sources that affordable housing builders frequently use for financing. The various kinds of financing that is required to purchase and /or operate a real estate investment is commonly known as the “capital stack.” Many affordable and market rate housing projects require multiple funding sources in their “capital stack” to pay for all the costs that arise.

- Federal & State Low Income Housing Tax Credit (LIHTC): A program where corporations invest in low income housing to pay less in federal taxes

- Mortgage: Money you can borrow from a bank that be paid back each year in loan payments, typically a 30 year loan

- Public (City, County, State and Federal) Funds: These are competitive funding sources that are applied for based on project tenant mix, overall goals and how it meets state and local housing priorities. These are either in the form of rental assistance or capital subsidies

- Private Philanthropy/Sponsor Loans/Gap Funding: Paid for by donations from foundations and individuals to make up the gap in the project between public subsidies and the cost of the project

What is area median income (AMI) and how does it affect rents in an affordable housing project?

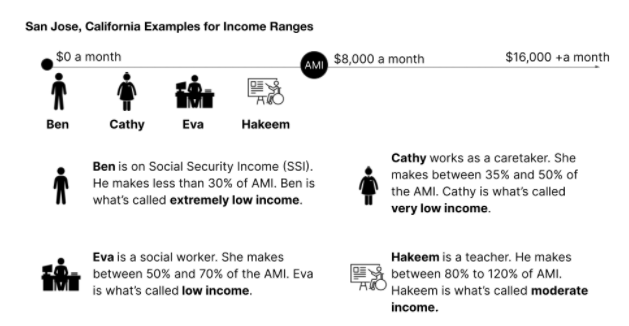

The area median income (AMI) is the average income for a given area, determined annually by the local government to gauge the incomes at differing household sizes. Each locality will have a changing AMI depending on the cost of living and range of incomes. Median means around the middle of what everyone makes, with half of people making less and half making more. For affordable housing, this number is used to decide how much rent people can afford.

Affordable housing buildings have pre-determined rent prices. These rents help pay for things like building maintenance, loan repayment and property taxes.

Housing is a critically important and necessary resource. People need to be able to pay for housing without spending all of their monthly income. Most personal finance experts recommend spending no more than 30% of one’s monthly income on rent. A renter looking for affordable housing will pay rent that depends on their income bracket.

Here are some examples about an affordable housing complex in San Francisco. Remember, San Francisco’s current AMI is $7800 a month. Here is what a studio apartment would cost for people with different AMI levels:

- Extremely low income people can make up to $2200 a month. They would pay $670 a month for rent in an affordable housing complex.

- Very low income people can make up to $3700 a month. They would pay $1120 a month for rent in an affordable housing complex.

- Low income people can make up to $4500 a month. They would pay $1350 a month for rent in an affordable housing complex.

- Moderate income people can make about $6000 a month. They would pay $1800 a month for rent in an affordable housing complex.

What are they and how are development costs and operating costs different?

These are various costs associated with creating an affordable housing project. Development costs are incurred as the project is being designed and built. The operating costs involve building maintenance and are incurred once construction is complete. Here are some examples of each.

Development costs are the costs to build a building. Examples include:

- Buying the land the building will be on

- Paying to make sure the land is a good place to build on

- Paying the city to get the okay to start building

- Paying someone to design the building

- Paying for what someone needs to build (like wood or metal)

- Paying people to actually build the building

- Paying the bank to take out a loan

Operating costs are how much it costs per year to run a building. Examples include:

- Paying staff to run the building

- Paying to keep the building in good shape

- Paying taxes on the building

- Paying for electricity and water

- Getting insurance for the building

Who is On Your Housing Team?

Part of a successful development process is selecting the right team. The process can take years and lots of engagement, so working with people you like, trust and respect is critical. Team selection is highlighted in the above table during the “Acquisition & Planning” phase. Below, please find descriptions of some core members you need when building affordable housing.

- Developer: Someone (nonprofit or for profit) that wants to build housing. Either the owner of the land the housing will get built on or it can be a company the owner hires to make sure the project gets built. Responsible for:

- Getting the okay from their city to start building

- Making sure zoning laws get followed

- Working with the architect to design the homes

- Getting money to build the homes

- Figuring out who will take care of the homes in the long term (property manager)

- Architect: The person who plans, designs and / or facilitates the execution of the project designs. Responsible for:

- Meeting with clients to determine objectives and requirements for structures

- Giving preliminary estimates on cost and construction time

- Preparing contract between the property owner and contractor

- Directing workers who prepare drawings and documents

- Preparing scaled drawings for the future building

- Other Consultants: There are many other people involved in the housing development process, each having a specialty to navigate technical requirements. Consultants include:

- Lawyers: Supports entitlement and financing phases

- Financial Consultants: Helps to determine if project is feasible, helps to apply to public subsidies, and makes sure housing is set to get paid for (closing process)

- Other Design Consultants like: Landscape Architect, Structural Engineer, Geotechnical Consultant, Mechanical/Electrical/Plumbing Consultant

Recap

Now you know the basics of Housing Financing. This information will make you a more knowledgeable advocate and informed ally in the creation of a disability-forward housing future. For a deeper dive, check out The Three Ps of Housing Affordability as a great example of “further reading.”